nebraska sales tax calculator by address

The Nebraska NE state sales tax rate is currently 55. Tax rates are provided by Avalara and updated monthly.

Car Tax By State Usa Manual Car Sales Tax Calculator

Nebraska City 20 75 075 16-339 33705 Nehawka 10 65 065 240-340 33740 Neligh 10 65 065 91-341 33775 Nelson 10 65 065 80-342 33880 Newman.

. Local Sales and Use Tax Rates Effective January 1 2021 Dakota County and Gage County each impose a tax rate of 05. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. When you enter the street address the calculator uses geolocation to pinpoint the exact tax jurisdiction.

31 rows The state sales tax rate in Nebraska is 5500. ArcGIS Web Application - Nebraska. L Local Sales Tax Rate.

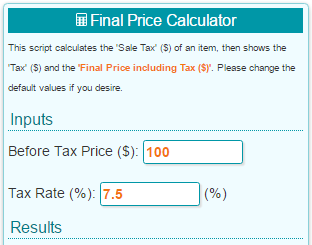

There are no changes to local sales and use tax rates that are effective July 1 2022. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. USA Tax Calculator 2021.

For State Use and Local Taxes use State and Local Sales Tax Calculator. USA Tax Calculator 2022. This is the total of state county and city sales tax rates.

There are no changes to local sales and use. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Nebraska is a destination-based sales tax state.

The Nebraska state sales and use tax rate is 55 055. Sr Special Sales Tax Rate. From there it can determine the corresponding sales tax rate by accessing.

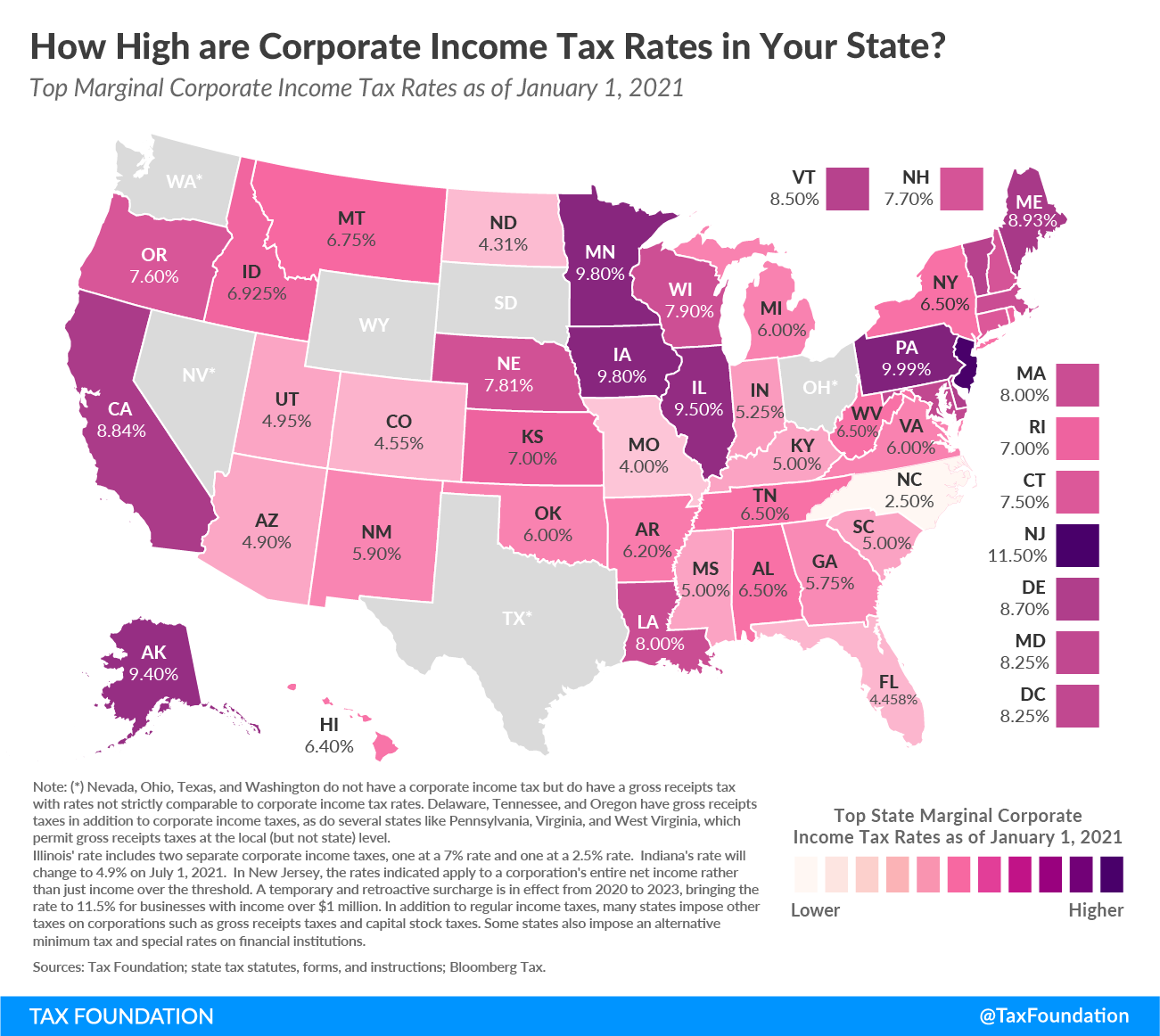

The state sales tax rate is the rate that is charged on tangible personal property and sometimes services across the state. For example the state rate in New. See the County Sales and Use Tax Rates section at the.

Monthly Tax Calculator. US Salary Examples and. Interactive Tax Map Unlimited Use.

With local taxes the. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. Groceries are exempt from the Nebraska sales tax.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. These usually range from 4-7. Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is.

So no matter if you live and run your business in Nebraska or live outside Nebraska but have nexus there you would charge sales tax at the rate. The Nebraska sales tax rate is currently. The Nebraska state sales and use tax rate is 55 055.

With QuickBooks sales tax rates are calculated automatically for each. Ad Lookup Sales Tax Rates For Free. S Nebraska State Sales Tax Rate 55 c County Sales Tax Rate.

Weekly Tax Calculator. Just enter the five-digit zip. Annual Tax Calculator.

New Mexico has a 5125 statewide sales tax rate. Average Sales Tax With Local. Look up 2022 sales tax rates for Washington Nebraska and surrounding areas.

Montana Salary Calculator 2022. The minimum combined 2022 sales tax rate for Omaha Nebraska is. Sales tax rates can change over timethe calculator provides estimates based on current available rates.

Sales Tax Rate s c l sr. Counties and cities can charge an. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15.

Calculate a simple single sales tax and a total based on the entered tax percentage. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. So whilst the Sales Tax Rate in.

Item Price 34 99 Tax Rate 8 Sales Tax Calculator

Sales Taxes In The United States Wikiwand

How To Register For A Sales Tax Permit Taxjar

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

States With Highest And Lowest Sales Tax Rates

State Income Tax Rates Highest Lowest 2021 Changes

Car Tax By State Usa Manual Car Sales Tax Calculator

How Is Tax Liability Calculated Common Tax Questions Answered

Lottery Tax Calculator Updated 2022 Lottery N Go

Nebraska Sales Tax Small Business Guide Truic

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

Missouri Income Tax Rate And Brackets H R Block

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction